How to Establish Credit

If you have never owned a credit card or taken a loan, your credit history is a clean slate. Because creditors and lenders use your credit history to give you a credit card or a loan, this clean slate makes you a risky candidate in their eyes – without a credit history they would have no evidence of how you manage your payments.

If you have never owned a credit card or taken a loan, your credit history is a clean slate. Because creditors and lenders use your credit history to give you a credit card or a loan, this clean slate makes you a risky candidate in their eyes – without a credit history they would have no evidence of how you manage your payments.

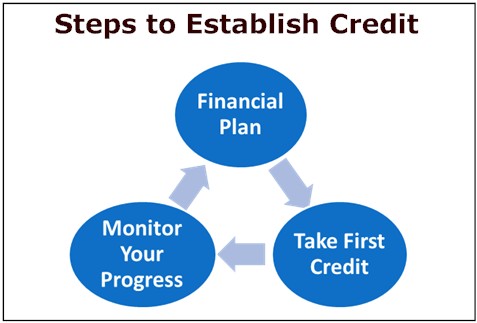

Learn how to establish credit in order to qualify for a credit card or loan.

Acquire a Secured Credit Card

A secured credit card is just like any other ‘regular’ credit card except that the potential cardholder is required to pay a security deposit – between $300 to $500 – as a guarantee that the debt will be repaid. The credit limit is often equal to the security deposit.

Creditors usually report the secured credit card activity to credit bureaus so the cardholder’s activity can be assessed.

Get Store Credit Cards

Some store credit cards, like those of Walmart, Target, Macy’s and others are easy to get and help build and rebuild a credit score as they have low credit limits.

Use the Credit Card, Don’t Abuse it

It is futile to obtain a credit card and then just sit on it. Use your credit card at least once a month for groceries or gas. You can build credit only if you are able to repay debt in a timely manner. The idea is to ensure the creditors that you can manage your debt repayment responsibly. It is advisable to not exceed 20%-40% of your credit limit – only make purchases on your credit card that you can afford to pay in full every month.

Pay on Time

Paying your bills and debt obligations on time is the most important factor in the process establishing credit. Even one late payment can damage your credit record and drop your credit scores.

Keep a Tab on Your Progress

Once you have learnt how to establish credit, you should maintain it. After about 6 months of timely credit card payments, check your activity status through your credit report and score. Closely analyze your credit report and check for any feedback to get an idea of what you need to work on (if any). Your credit score will help you make sense of your credit report.

Apply for an Unsecured Credit Card or Loan

Twelve months of timely payments is sufficient time for you to learn how to establish credit and let your creditor know that you can manage debt responsibly. Now you can switch from a secured to an unsecured credit card. An unsecured credit card requires no security deposit and offers higher credit limit. Acquiring a new loan that you can repay on time will also boost your credit score.